Introduction

Pushed by the rest of the market, SAP SE (SAP) shares have plunged in recent days. But the long-term outlook has not changed. Both the external secular trends and the internal competitive advantages make this company a safe bet for the future. Even these turbulent times can become a new reason for an increase in customer demand for its products and services.

But we must keep an eye on the growth in the long term and make sure that the valuation is not still too high even for a quality business like this.

Megatrends

Whenever I start analyzing a company, the first aspect I check is how the Megatrends affect its business. With Megatrends, I refer to secular trends in the macro-environment, not affected by short-term events. In this way, even if things don’t go as expected in the short term or the valuation I calculated was too optimistic, I can expect that the long-term tailwinds will make me recover the investment. An asymmetric bet.

In the case of SAP, there are different Megatrends that will make it to be profitable for many years. In the first place, we are still in a digitalization process. All the new information that is being collected or will be in the future will be required to be integrated, processed, and presented in a useful way for making good decisions. Within this trend, we can also distinguish the current movement of many companies to externalize their data management in cloud providers, as SAP is offering with its cloud solutions. In the second place, and especially in some parts of the world, where demographics will be an issue, we can expect further requirements for automation. Again, something only possible if integrated with the main software of each company. In third place, even with some current rumors about returning back home some operations, it does not seem plausible to end the globalization trend of the last years completely. There, a global ERP provider, like SAP, the indisputable leader in the world is going to have a big advantage. And finally, the shortening of development cycles it is requiring more agility in all the different sectors. Which again requires having in place a robust and potent software with enough flexibility.

Moats

Normally SAP is presented as an example of a typical moat of switching costs. And in fact, it is. When SAP is implemented, not only the software has to be customized to the specific business, but the business itself has to adapt to it. In all implementations of the core ERP, it is required some process reengineering and the development of new interfaces with the specific pieces of software not included in the platform.

But talking only about the switching costs as the moat simplifies much the reality and it moves the attention to the key moat. In the end, if the success of SAP were only the switching costs, their competitors could invest in marketing or lower their prices, and once inside the customers they wouldn’t allow SAP to attack their market share.

In the last annual report, they summarized their business model in the following way:

We create value by identifying the business needs of our customers, then developing and delivering cloud solutions, services, and support addressing these needs. By proactively obtaining customer feedback on a quarterly basis, we strive to continuously improve our solutions, identify further business needs, and deliver enhanced value to our customers across the whole lifecycle thus increasing customer loyalty.

Sometimes these kinds of statements might seem like standard wordiness to keep investors and other stakeholders happy. But in this case, I think it is really relevant the stress they make on customers’ needs. Especially because they have been doing this for years in thousands of big companies.

One way in which Warren Buffet proposes to check if a company has a moat is by wondering if any other with unlimited money could take its leadership away from it. In this case, even with all the analysts and programmers workforce, we could imagine, we wouldn’t be able to build a similar platform. Because, first, we wouldn’t know what to build. Customers wouldn’t be able to detail all their requirements. And even if they did, we wouldn’t be able to debug the software till getting the robustness of SAP core software. So the key moat of SAP is its proprietary software platform developed over many years and over many different customers. And that really looks very difficult to overcome by its competitors.

But these ones are not the only moats SAP has, although in some way they reinforce each other. At the moment SAP is like a standard in big companies. There was a saying some years ago in the tech sector that said “Nobody was fired for buying IBM”. Deciding on a new ERP is a big decision that can definitely influence in the managers’ fate if making it wrong. So not many of them will risk what can be a disaster even if they can decide on cheaper solutions. Apart from that, being a so extended software create also some network effects. It will be easier to integrate new employees if they already have some knowledge of SAP. And it will be easier to find consultants, programmers, or support staff if we are talking about the leader in this kind of software. Finally, SAP, being the leader, has also some scale advantages. Being able to spend more on R&D can give it an advantage, especially with the rise of new technologies and cyberattacks.

Risks

But, there is always some drawback. Being a leader in ERP implementations in big companies for so much time raises a question. Is there still enough room to grow for a company so big in this sector?

For sure with the moats commented in the last point we can expect some pricing power. So, at least, we can expect to pass the inflation through its customers and even a little bit more. But, in order to grow significantly, it would have to increase its customer base or the products/services offered to them.

According to the website Statista, the global spending on Enterprise Software in 2022 is expected to be $672 billion. Given that SAP currently has a Total Revenue of $32 billion, it appears that there is still some available market to chase. But we must take into account that for some of that spending, the competitive advantages of SAP might not be so strong. So we should keep an eye on this.

Short-term environment

Given the above long-term analysis, it seems that the current sell-off might be due to short-term causes. Undoubtedly, the macro environment is quite challenging. High inflation, supply chain restrictions, war, energy price, and possible recession are all factors that are affecting SAP’s customers and will do it for some time.

Asking about this concern in the last call, Christian Klein, SAP’s CEO, answered in this way about the conversations they have with his customer’s managers:

Yes. So look, of course, in the conversations, concerns come up about the rising inflation and can customers really put this inflation and then the increase in their cost base always on top on the pricing side. But then the next part of the conversation is, can you help me on cash flow optimization. And then we come into the play where we say, hey, okay, we connect you with the platform with RISE to our network, we give you access to more suppliers. We have now Taulia connected to it, where we can hopefully also get better financing conditions. We have actually good ways with S/4HANA Cloud on offering, making sure you can offer much faster new services with new license models, which also can help you to drive higher customer retention and hopefully higher prices.

…

So, while the world becomes more complex, software is needed to overcome this complexity. And this is why we definitely don’t see a hit on our pipeline. It’s the other way around. We actually see strong multiples, and we will remain very confident also about the further acceleration of our cloud business.

If SAP is able to add value with its existing and new solutions, customers could see it as a solution, more than an expense. And this could make it not suffer even in the short term.

Valuation

But even with the most compelling moats and prospects, there must be a reasonable price above which, we shouldn’t consider investing in SAP. This price is going to depend mainly on the growth SAP is able to generate in the next years.

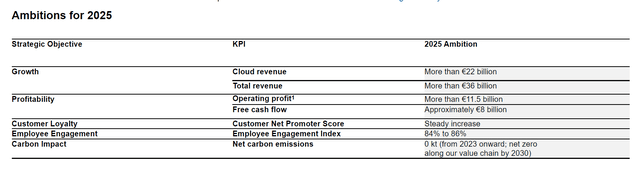

In the last call, they confirmed that they still see feasible the long-term plan that they disclosed in 2020. In it, they expect to get a Revenue of €36 billion and a Free Cash Flow of €8 billion by 2025. So, we are going to use these figures in order to calculate a rough estimation of the intrinsic value of SAP.

2025 Ambition Plan (20-F 2021 Report)

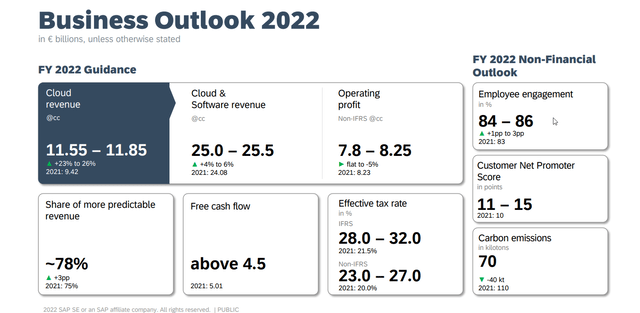

On the other hand, for this year, they are even expecting a Free Cash Flow below the one achieved last year. They expect it to be above $4.5 billion.

Outlook 2022 (2022 Q1 Earnings Call Presentation)

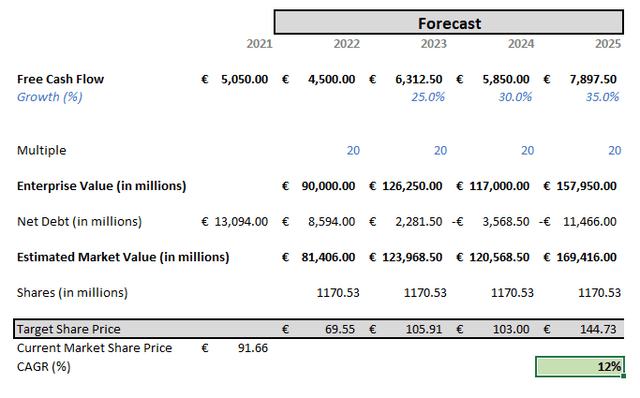

In order to get to the 2025 goal, let’s assume that they achieve FCF growths of 25%, 30% and 35% for the years 2023, 2024 and 2025. We would get then approximately €7.9 billion by the end of 2025. Which after applying a multiple of 20 (given the quality and prospects of the company) we achieve an Enterprise Value of approximately €158 billion.

Rough Valuation – SAP (Created by Author)

f we add to the current Net Debt, the Free Cash Flows estimated for these years, we will get a Net Debt of minus €11.5 billion by 2025. Which, once removed from the Enterprise Value gives us an Estimated Market Value of €169 billion. Dividing it by the current number of shares (1,170 million) we get an Intrinsic Value Share of approximately €145 by the end of 2025. This, applying the current exchange rate (1.055 $/€) makes a value in dollars of $153.

This would give us a compound average growth rate of 12% for the next 4 years. It is not too much but given the quality of this company and the possible bad scenarios that are being currently forecasted it can give us some stability to our portfolio.

Conclusion

In the long term, it seems difficult to be wrong in investing in SAP. There are only two major risks to take into account and monitor. One is growth. As the company gets bigger it has to increase even more its revenue in order to maintain the same growth rate. And given the extended use of the core ERP in big companies, it might have to find additional sources of growth. The other one is paying too much for its shares. Taking advantage of the current market pessimism might be an opportunity to get a good price.

Recent Comments