What were the last results of Card Factory ($CARD)?

On May 3rd, Card Factory published its annual report for FY 2022.

The revenue went up by 27.8% year-over-year, reaching GBP364.4 million. But, this is not a good comparison because last year, several stores were locked down due to the COVID-19.

Like-for-like sales, considering locked-downs, decreased by 3.9%, but it is achieving its pre-pandemic level in a year without restrictions.

Online sales went down, but they are still higher by 30% than before the pandemic. According to the Management, this is due to three factors:

- Expansion of product range

- Improved customer experience

- Change in customer behavior

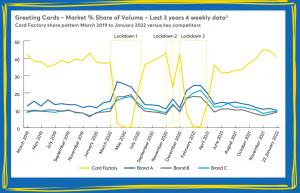

The main message the Management sends is that despite the hard times of the retail closure, Card Factory has remained the leader in UK greeting cards sales. Its market share was reduced to 20% in 2020, but in 2021 it achieved 24%, and they expect to achieve its pre-pandemic level of 33% soon.

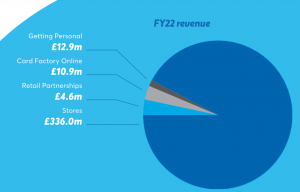

Below we can see the revenue distribution among the different channels.

What is the primary Strategy of Card Factory ($CARD)?

The Management points out three main strategic lines:

- Increasing breadth of product offering

- It means adding additional products or complements used in greeting parties or given as presents.

- Create a full omnichannel offer

- This is a trend we also saw in Inditex. Integrating the physical stores with the online business can give Card Factory a significant advantage over its competitors.

- They are also implementing features such as purchasing online and collecting in the stores.

- Combining both worlds in a sector with so many references and at the same time with an enjoyable experience in the stores can increase loyalty and recurrent revenues.

- A robust and scalable central model

- Another strength Card Factory can use against the competition is its vertical integration.

- Its cards and products are designed, manufactured, and retailed in-house, which gives them more control over the products and more information to exploit.

What is the Outlook for Card Factory ($CARD)?

The Management has confirmed its expectations of returning to FY2020 results (GBP451.5 million in revenue, an increase of 24%).

What is the intrinsic value of Card Factory ($CARD)?

The intrinsic value will vary widely depending on how much growth we are willing to input in the calculation. If according to the Management, CARD returns to FY2020 results, we would be talking of GBP76 million of Operating Profit.

Considering the expected growth and history, we could expect a multiple of 15. So multiplying the forecasted Operating Profit by the multiple, removing the current net debt (GBP192.3 million), and dividing it by the number of shares (342.37 million), we would get a target price of GBp276.81 (almost four times the current market price).

Recent Comments