INTRODUCTION

This course is just an introduction to my approach to Value Investing.

It does not pretend to be a complete course, nor involve any recommendation. I firmly believe that there is not a best way of investing, as there is not a best way of doing many things.

All of us are the result of our genetics, experiences, readings, … and are more suitable for one or another kind of approach. I even think that there are as many frameworks or methodologies as investors in the world. Although some of them contain some common characteristics, we can always adapt them to our own personality or our own circumstances (and we should do it if want to be successful).

WHAT IS STOCK VALUE INVESTING?

Value Investing is based on the assumption that we can estimate the value of a stock and that this value is not always the same as the market price.

Whenever our estimated value is higher than the market price, we have an opportunity to invest in it. In the same way, whenever the market price exceeds our estimated value we can sell it earning a profit (or if we hadn’t purchased it previously, we can just ignore it and wait for the price to be below our estimated value).

HOW DO WE ESTIMATE THE VALUE OF A STOCK?

The value of a stock will be the the value of the company that issued this stock divided by the number of shares in circulation at a given moment.

So the only way of estimated the stock value is estimating the company value.

There are different ways of estimated the value of a company. The two main ones are:

- Estimating the returns this company is going to give back to its investors

- Whether through the payment of dividends or shares buybacks, these returns will increase the cash of the investor or their share of the company.

- It is a common way of estimating the value of every asset, estimating its future return cash flows, and discounting them to the current day through a predefined factor.

- Estimating the value of the assets of the company

- In some cases, depending on the nature of the company, it can be more convenient to just value the company based on the market value of its assets

A popular approach, or rule of thumb, of using a multiple of the earnings for estimating the value is just a variation of method 1. In which, instead of calculating all the cash flows and discounting them, we simply assume that they will be dependent on the current or forecasted earnings of a given year and multiply them by a multiple. Taking into account that it is not possible to estimate with accuracy the future cash flows, that can be a more efficient way for making a rough estimation of the company value.

WHAT OTHER FACTORS TO TAKE INTO ACCOUNT IN STOCK INVESTING?

Value Investing philosophy gives us the main framework of how to analyze if a stock is a good investment or not. But some of the advantages of investing in stocks are that we can invest small portions of our funds (even with a small portfolio, it is possible to manage several stocks) and that unless we manage big amounts of capital, we can enter and exit quickly from our investments.

To take advantage of these characteristics of the stock market, it is important to have a robust strategy of how to manage our portfolio risks and how to manage our emotions in the decision making.

Normally Portfolio Management and Behavioral or Emotional Control are a small part of the Value Investing courses or books, but I think their importance must be highlighted and we should analyze the different actions and procedures in order to introduce them in our decisions making process.

MY FRAMEWORK TO VALUE INVESTING

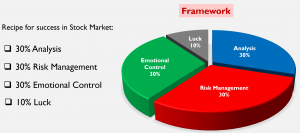

Some years ago I came across the following quote (attributed to Benjamin Lee):

“The secret recipe for success in Stock Market is simple:

30% Market Analysis Skills,

30% in Risk Management,

30% in Emotional Control,

and 10% in Luck.”

And I found it a very convenient way of splitting the different tasks or big areas I should consider in the management or my stock portfolio.

So in this introductory course to Value Investing, I will follow this structure, writing my approach to these four big blocks in different sections.

Recent Comments