Cars.com is basically an online marketplace that connects car buyers and sellers. It was founded in 1998 and is based in Chicago.

Their main customers are local dealers. According to the last quarterly results report released on May 6th, they account for approximately 88.7% of total revenue.

An old adage about brick-and-mortar business says the three most important factors are location, location, and location. We should replace them with traffic, traffic, and traffic in online businesses. Of course, there are other important factors. But usually, the revenue correlates to the number of visitors to a shop. And if these visits don’t require a significant expense in advertising, the business can have a big competitive advantage.

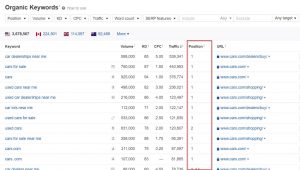

I think the best moat or competitive advantage of cars.com is being able to attract so much organic online traffic. This traffic usually comes from results from search engines. In Ahrefs, we can check through which keywords a potential buyer has searched and how each website ranks or in which position it appears in the search results. If we see the main keywords through which most users arrive at the cars.com website, we get this list:

As we can see, cars.com ranks first in promising searches. It is not only necessary it brings traffic to the site but also its quality. Somebody searching “cars for sale” is likely to be thinking about buying a car, so it is definitively the correct lead for a dealer.

Cars.com is aware of this, and they are even offering additional services to the dealers, such as the use of promotional videos for these visits with the FUEL program. You can check how it works in the site fuel.cars.

As long as cars.com can maintain this position in the search results and these visits numbers, it will bring value to the dealers and continue achieving the constant free cash flows they have been getting in the last years.

Risks

The main risk I can find in this business, or at least the big drawback, is growth. Currently, cars.com is selling its services to around 19,500 dealers. In the call commenting on last quarter’s results, the CEO said they still have room to grow in 40,000 dealers.

Indeed this would imply multiplying by three the current number of customers and potentially the revenue. But looking to the long term, even talking as we are about a small company (around $680 million), we cannot expect a multi-bagger if they stick to the current business. Of course, they can expand geographically or to other adjacent businesses in the future.

Their current strategy of combining the increase in their customer base with adding more services to them, like the recent purchase of Accu-Trade (for valuating vehicles) or CreditIQ (for offering loans), makes a lot of sense. As more services are used from cars.com, the switching costs to another platform will be higher. In addition, to attract new dealers, they also increase the loyalty of their existing ones.

Capital Allocation

Due to the high free cash flow that the company generates, cars.com is in an excellent position to reinvest in its business, buying adjacent services providers as commented or returning capital to shareholders through buybacks.

In fact, they have in place a repurchase program to acquire $200 million in shares. At the current market price, this amount represents almost a 30% of the company. During the first quarter of 2022, they have repurchased 0.3 million at an average price of $14.78 (currently is trading at $9.8).

Finally, it is also a good signal that some of the company officers have been recently buying shares for $9.85.

Recent Comments